What is the difference between the two?

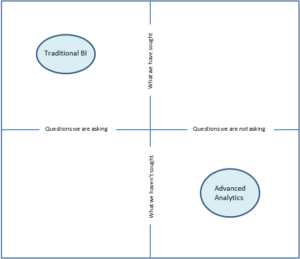

Let us imagine a quadrant. The left of the x- axis is “Questions we are asking“, and the right is “Questions we are not asking.” Similarly, the top of its y-axis represents “What we have sought“, and the bottom, “What we haven’t sought.”

The upper-left area of the quadrant is where traditional BI would reside, while advanced analytics would be in the lower-right section.

The difference between the areas of the quadrant represents the distinction between these two approaches.

Traditional BI systems have been focused mostly on hypothesis based reporting with its foundation in historical data and past results, to answer the question of “What happened?” Plus, they require the expertise of the arcane few report developers- typically data scientists or data analysts- to create highly-formatted reports and dish out insights to a department or an entire organization.

However, the ballooning scale and diversity of data means that these systems are no longer enough to uncover all the data in the organization and extract useful insights. That is why more and more businesses are transitioning from these traditional, reactive systems to advanced analytics systems.

These platforms are well equipped to proactively extract and compile data from a humongous variety of sources from outside the enterprise, and extract relevant intelligence that helps to uncover new correlations, customer behavior patterns, revenue opportunities, and other strategies every day.

What’s more, with business analytics, all of these capabilities come wrapped into a self-service delivery system that lets business users and subject matter experts gain easy access to all the information necessary to make their analysis, and presents valuable insights so that they can reach their goals in lesser time.

By wading through an ocean of data regardless of where it resides and fetching and presenting insights in an easy-to-understand format, Advanced Analytics systems empower business users to anticipate “what” might happen moving forward given the uncertainties in the dynamic business environment.

Traditional BI: A Dead Horse or Still Living On?

In its recent BI Summit keynotes, Gartner has been proclaiming that BI is dead. A recent Magic Quadrant report explains:

The BI and analytics platform market’s multiyear shift from IT-led enterprise reporting to business-led self-service analytics has passed the tipping point….During the past several years, the balance of power for business intelligence (BI) and analytics platform buying decisions has gradually shifted from IT to the business.

Tools that do require some form of IT intervention have been relegated to Enterprise-Reporting Based Platforms Market Guide. They are no longer considered BI, and no longer appear on Gartner’s BI Magic Quadrant.

Some analysts, however, have a different take. They believe that while its glory days may indeed be in the past, traditional BI still works well in certain use cases.

Enterprise BI tools still serve a purpose in meeting the functional, operational, financial [and] compliance reporting needs across all industry verticals. They are capable of providing highly scalable and standardized reporting with guided analysis in relation to —‘what happened’ (historically) or ‘what is happening now’ (operationally).

But, most analysts agree that the demand for traditional BI tools is flat or slowing down and the future lies in advanced analytics, data visualization, data discovery and quick insight—a platform that can process high quantum of information in real time, and leverage data and analytics to support decision making at speed and scale..

Why Advanced Analytics?

Advanced Data Analytics can answer some of the toughest business questions, and uncover what was previously invisible, improving operations, customer experiences, and strategy. We are now starting to see it become more firmly embedded into the enterprise with increasing business use cases.

- Deeper Customer Engagement

Traditionally businesses have applied analytics retrospectively on highly structured, at-rest customer and campaign data.

However, to be more attuned to today’s customers, it is necessary to leverage in-motion data for real-time analysis; they need to apply analytics as customer interactions occur to drive deeper personalization and enhanced customer centricity.

For instance, to build contextual marketing engines, businesses need answers to sophisticated questions. When are individual customers likely to exhaust their supply of a certain item? (based on study of consumption patterns, product/part failures etc.) What time of the month is an offer most relevant to your target audience? And, what level of profitability might be attainable at such times? What are the specific price points at which consumers have the highest likelihood of purchasing a certain product? Combined with AI, advanced analytics can have a powerful effect in revealing such previously hidden answers.

Many companies are also using social media sentiment to make more informed decisions about product lifecycle management and sales offerings. Leveraging Twitter sentiment analysis, for instance, can help uncover correlations between Twitter discussions and sales data, which can then be used to recalibrate marketing campaigns in real-time.

- Enhancing Operational Efficiencies

Artificial Intelligence combined with the power of advanced analytics is helping complex supply chains reduce waste and boost efficiencies.

This is useful in myriad ways, for instance, a manufacturer can locate inefficiencies in the production process and work on ways to provide predictive maintenance. An oil drilling company can thus predict in advance when drill bits are likely to break based on factors like RPM, weight on bit, rock formations, etc. rather than going through the process of replacing broken ones. Similarly, a retailer can optimize his supply chain to figure out how much inventory to hold versus how much to pay for his transportation costs.

- Improving Channel Effectiveness with a Single Customer View

A multinational bank might have multiple customer touchpoints. This complicates the relationship between the bank and its customers, and drives the need for a single view of the customer.

Issues such as siloed operations and an inability of legacy systems to address the dynamic nature of the customer ecosystem can be major hindrances.

Applying advanced analytics on the bank’s existing data, a product-by-product analysis of each of the bank’s sales channels can be carried out to reveal channel opportunities. Armed with better insights into customer engagement, the bank can enhance channel effectiveness and develop thoughtfully designed end-to-end customer journeys.

- Reducing Employee Churn

Advanced Analytics can also be used to identify causes of employee churn and improving retention.

Paschall Truck Lines (PTL) is one such company that is using advanced data analytics to its advantage. By moving their database, which contains records on everything from the driver’s past experience and work history to geo location and more, to advanced analytics platforms, the company has been identifying correlations between hiring areas and retention terms.

Such analysis uncovers previously hidden insights on drivers’ performance that help in restructuring of hiring patterns, ultimately leading to employee turnover reduction.

- Improving Investment Decisions

In combination with AI, advanced analytics has the potential to drastically improve investment decisions. AI systems can crawl through and analyze press releases, social media content and news that may have an impact on stock prices. This can be integrated on top of client performance data to forecast potential changes and help investors bid accordingly.

Conclusion

While many companies already use and operationalize business intelligence applications within their business processes today, they have only scratched the surface of what they can accomplish with external and internal data. By 2020, predictive and prescriptive analytics are estimated to attract 40% of enterprises’ net new investment in business intelligence and analytics. Its early adopters will reap major benefits, while laggards will get left behind.

- Why Test Automation plays an important role in Retail Digital Transformation - May 14, 2021

- Transformation of POS systems- A serious challenge for Testing - June 7, 2018

- Aspire is Back Again at Temenos Community Forum 2018! - April 23, 2018

Comments