The accounts payable team is the backbone of any organization, as it enables the healthy functioning of business by optimizing cash flow, preventing fraud, and maintaining a healthy relationship with vendors and suppliers. Advancements in automation technologies such as RPA (Robotic Process Automation), AI (Artificial Intelligence), and BPM (Business Process Management) have made the accounts payable process an area of focus for improvements with automation. This blog explores interesting ways of automating accounts payable by delving deep into what accounts payable is, the general manual process of accounts payable, the challenges faced in the manual process and everything one needs to know about the accounts payable automation.

What is Accounts Payable?

Accounts payable is the management and categorization of short-term debts and liabilities of an organization. This is why you might have noticed that accounts payable is indicated as current liabilities on the balance sheet of your company.

This can include scenarios such as amounts owed to vendors when purchasing inventory on credit and paying outstanding bills for fixed costs. Accounts payable is all-encompassing, as it manages every debt or liability of the business.

Accounts payable manages every expense incurred by the company through day-to-day operations by tracking and completing these expenses that usually fall into these categories:

- Travel expenses such as arrangements for flights, hotels, taxis, per Diem, etc. for employees

- Internal finance: reimbursing business expenses and distributing petty cash to employees

- Vendor payments: paying invoices and managing vendor information for inventory purchased on credit

- Reducing costs: negotiating favorable payment terms and finding ways to save or consolidate money on all costs incurred by the business

General Manual Accounts Payable Process

In order to see the benefits of automated accounts payable software, let us first examine how today’s manual accounts payable process works without automation. Generally, capturing information and processing invoices for payment involves the reliance of the accounts payable team upon multiple business units, procurement teams, and third-party vendors or suppliers. In order to ensure the timely processing of accounts payable, businesses even outsource the work to an external team, use business process outsourcing (BPO) to handle logistics, or use Shared Services set up with vendors and suppliers. This works to a certain extent, as external shared service centers handle a high volume of invoices, but the downside is that these approaches expose your important business processes and data to a large external team. Formats for supplier invoices can be categorized into:

- Paper invoices

- Word documents

- PDF attachments via email

- Custom formats found via the vendor portal

Invoices for the accounts payable process in a business can be categorized into:

- Service payments invoices

- Internal employees’ expenses

- Purchase-order invoices

- Non-purchase-order-based invoices

- Invoices for raw materials

- Invoices for freight charges incurred for business operations

As you can see, there is no structured layout for invoices as they are either semi-structured or unstructured.

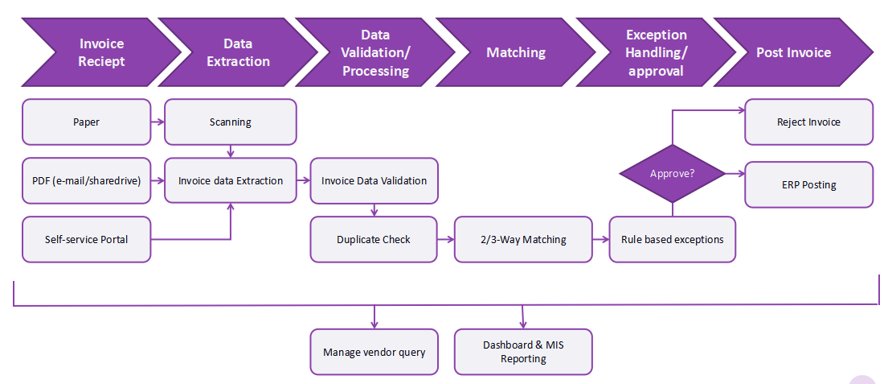

The manual accounts payable process is described in more detail below:

- A purchase order (PO is created by your procurement team that serves as a contract between your business and the third-party vendor to exchange cash for their products or services. Basic information such as quantities of the materials, the agreed price of the order, when to fulfill the order and more are laid out in the purchase order.

- A Goods Receipt Note is generated once the invoice comes in and the goods or services are delivered, which in turn gets handled by a master of GRN assigned to approve these documents. It is maintained in the system and then later used to perform business validations.

- The quality control (QC) team scrutinizes the items delivered according to different parameters for the deliveries and materials depending on the organizational policies. This QC team scrutinizes the items delivered according to the acceptability of the delivered items within each order and how closely the inspected order matches the original PO. If in case of any mismatch or damage, the vendor will be approached for credit or replacement.

- Most organizations implement a bifurcation of processes in this scenario of damage or mismatch. The two teams decide where the discarded and rejected items go and what to do with the accepted portion of the order which is smaller than the original quantity laid out in the purchase order.

- An invoice is then shared by the vendor that lists the price and quantity of goods delivered in their records – indicating what they have delivered at what price. However, before your AP team makes the payment. There is a thorough two-way match or three-way match of that invoice for non-purchase-order & purchase-order-based invoices, respectively, made against PO or the GRN before the accounts payable team approves the payment.

- The last step before the company sends payment to the vendors account involves the payments team clearing all incoming invoices with the QC and GRN teams after reviewing all the details.

Challenges faced in the Manual Process

Streamlining the manual accounts payable process involves three significant challenges which emphasize the importance of automated accounts payable automation solutions.

- Volume – by conservative estimates, any mid-sized or large-sized business receives hundreds or thousands of invoices in a week

- Time – It takes approximately between 4 and 16 days for companies to complete the processing of an invoice from receipt and payment approval.

- Cost – Both the cycle time and cost are affected by the manual processing of an invoice as it costs as much as $23.

Using automation to automate accounts payable typically involves the combination of RPA, AI and BPM, companies can replace manual effort involved in tasks such as deleting purchase orders, scanning invoices, data entry for verification, and posting the data into ERP systems.

- Robotic Process Automation

Robotic Process Automation is most helpful for rule-based scenarios in the accounts payable process. Once programmed and trained, RPA software bots are able to perform the tasks day in and day out 24 hours a day 7 days a week with no “bad” days, “vacation” time, health insurance benefits, and overtime pay, as incurred with human employees. One scenario to using RPA would be to process invoices that always have the exact same layout and fields.

- Artificial Intelligence

Artificial Intelligence (AI) is best suited for cases where an additional layer of intelligence is needed to go beyond the capabilities of RPA. It can be used to constantly train RPA bots by employing machine learning and adjusting the automation process where invoices, purchase orders, and data entry rules change day to day.

- Business Process Management

Maintaining cohesion between the accounts payable and other departments provides one centralized and automated workflow so that team leaders can communicate with each other seamlessly. Business Process Management (BPM) helps leverage RPA and AI by bringing them under one roof in a more intelligent fashion for team leaders. This need for centralization makes BPM the most important finishing touch in automating the accounts payable process, as without it, automation would be a soup of disparate tools in a piecemeal fashion.

- Volume – by conservative estimates, any mid-sized or large-sized business receives hundreds or thousands of invoices in a week

- Time – It takes approximately between 4 and 16 days for companies to complete the processing of an invoice from receipt and payment approval.

- Cost – Both the cycle time and cost are affected by the manual processing of an invoice as it costs as much as $23.

How to use Automation technologies for Accounts Payable

Using automation to automate accounts payable typically involves the combination of RPA, AI and BPM, companies can replace manual effort involved in tasks such as deleting purchase orders, scanning invoices, data entry for verification, and posting the data into ERP systems.

- Robotic Process Automation

Robotic Process Automation is most helpful for rule-based scenarios in the accounts payable process. Once programmed and trained, RPA software bots are able to perform the tasks day in and day out 24 hours a day 7 days a week with no “bad” days, “vacation” time, health insurance benefits, and overtime pay, as incurred with human employees. One scenario to using RPA would be to process invoices that always have the exact same layout and fields.

- Artificial Intelligence

Artificial Intelligence (AI) is best suited for cases where an additional layer of intelligence is needed to go beyond the capabilities of RPA. It can be used to constantly train RPA bots by employing machine learning and adjusting the automation process where invoices, purchase orders, and data entry rules change day to day.

- Business Process Management

Maintaining cohesion between the accounts payable and other departments provides one centralized and automated workflow so that team leaders can communicate with each other seamlessly. Business Process Management (BPM) helps leverage RPA and AI by bringing them under one roof in a more intelligent fashion for team leaders. This need for centralization makes BPM the most important finishing touch in automating the accounts payable process, as without it, automation would be a soup of disparate tools in a piecemeal fashion.

Some use cases in the accounts payable process where RPA and AI can be applied to eliminate payment delays and mitigate human errors:

- Capturing data intelligently from different types of physical, scanned, emailed, faxed, and electronic invoices through EDI systems

- Sorting and classifying invoices

- Checking for invoice duplication

- Validating data against ERP

- Flagging invoice exceptions

- Routing invoices for approval

- Payment and task reminders

- The flow of information through multiple systems and platforms

- Generating insights through reporting and analytics

Best Practices for Automated Accounts Payable

Here are a few guidelines and best practices that can be used by organizations while implementing an automated AP process:

- Centralizing the accounts payable process eliminates redundancy and reduces the processing time, mistakes in data entry, and erroneous ordering and payments

- Establishing paperless processing brings about significant advantages with reduced processing time and reimbursement coupled with transparent communication.

- Setting up reminders for payments allows businesses to avoid missed or late payments and also take advantage of discounts.

- By categorizing and automatically approving certain types of payment requests made by specified vendors and suppliers, one can implement robust governance protocols in accounts payable procedure.

- Eliminating the need to talk to a representative by setting up vendor portals is one of the best practices for automated accounts payable process.

- Implementing a streamlined reporting system for the accounts payable office helps produce the requested information about the complete budget and spending details in the event of an audit or a budget meeting

- An accounts payable process using automation should implement 3-way match authentication to ensure that only valid, accurate invoices are paid.

- Ensuring that data is archived by using audit trails makes archiving records very simple.

Popular tasks to implement automated AP process

Most popular tasks within the accounts payable process to be automated include:

- Touch-less Invoice Processing

Structured invoices handled by RPA alone while processing semi-structured and unstructured invoice formats need advanced automation with the help of artificial intelligence. AI models that are trained with RPA bots can interpret and extract data to eliminate human involvement in a wide variety of invoice formats.

- Restructuring Invoices in case of rejected items

In case of scenarios where there are rejected or missing items in the delivery, all teams involved in the accounts payable process should make changes to their typical procedures of handling invoices. Leveraging BPM helps enable teams to work seamlessly even when orders change by offering them a centralized platform to check and communicate on the workflows. Such teams include procurement, security, receiving management, and masters of GRN.

- Categorizing Invoices

There is a vast category of invoices within various companies. BPM helps each category to have its independent flow and associated business rules by recording them and assigning proper team members, enabling even complex rules to be followed to the letter.

- Invoice data entry

Leveraging RPA bots to seamlessly interact with a wide variety of applications and systems such as ERP and accounting platforms to feed the data extracted from the invoice helps expedite the accounts payable process and minimize the risk and cost of human error.

- OCR Data Extraction

Leveraging AI models to bypass the barrier of using OCR to parse invoice documents when there are images, handwriting samples, and other complex unstructured data elements helps in building automated process platforms that are resilient to document structure changes

- Two-way and three-way PO matching

The two-way and three-way PO matching of invoices involves comparing items line-by-line against purchase orders and goods receipts to ensure the authenticity of the invoices by finding discrepancies in purchase amounts or vendor information. Performing it manually is a highly time-consuming and laborious activity which is highly irksome and burdensome for the accounts payable team. Using RPA bots to automate most of this manual matching reduces the human oversight required, thus freeing up the accounts payable team employees to focus on budgeting and planning.

- Invoice and Payment approval processes

Human oversight and intervention are considerably reduced by automating the invoice and payment approval process. Automatic routing of invoices to the appropriate approved saves the time required in processing. Upcoming deadlines too can be reminded by triggering automatic follow-ups.

Benefits of using Automated AP Process Solution

Now, let’s look at a few benefits of using automation in the AP process:

- Drastic reduction in turnaround time

- Increased transparency by using BPM, explainable AI, and audit trails in RPA

- Improved regulatory and audit compliance

- Huge improvement in data accuracy

- Drastic reduction in human errors and hidden costs

- Proper optimization of cash flow

- Improvement in vendor relationships and enhanced customer satisfaction

Conclusion

Using automation in the accounts payable process helps in building stronger vendor relationships and optimizes internal processes while enabling the business to generate maximum ROI on every cent. It enables the accounts payable team to see the needless headaches, risks, waste of paper invoices, and manual workflows disappear by using an automated solution. Thus, by adopting an automated platform, your AP department can become a part of your well-oiled and value-built enterprise that sees productivity and profits soar into the sky.

Comments