Back in the day, applications related to the financial domain were handled by Expert Systems, a domain of AI. An expert system is developed by capturing the Human Expert’s knowledge into a set of programming rules to assist in decision making. These have been used in medical diagnosis, fraud detection, prospecting and mineral detection etc. A major limitation of an Expert system is that they require full information to be given as input and hence deal poorly with uncertainty. The reason why Artificial Neural Networks have been gaining popularity in recent times in dealing with financial applications is they are better in handling uncertainty compared to expert systems. Financial applications primarily involve predicting the future events based on the past data. Considering the scenarios involving predictions, following are the primary areas where neural networks can be effectively used:

- Stock Market Prediction/Stock Market Index Prediction

- Loan Application Evaluation & Underwriting

- Credit Card Customers Search

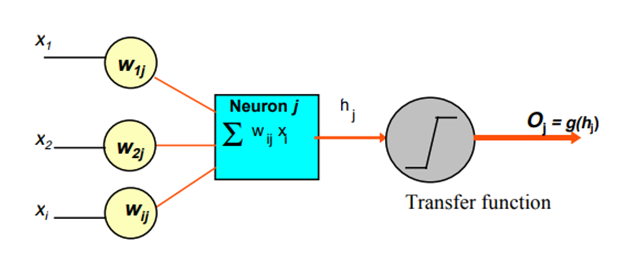

An Artificial Neural Network (ANN) mimics the human brain’s biological neural network. ANNs consist of many interconnected processors known as neurons that perform the summing function. Information is stored in the weights on the connections.

The basic structure of an ANN consists of artificial neurons (similar to biological neurons in the human brain) that are grouped into layers. The most common ANN structure consists of an input layer, one or more hidden layers and an output layer. A modified simple model of an artificial neuron is shown in this figure.

Stock Market Prediction/Stock Market Index Prediction

Predictions for stock market indices and stock values are handled by the neural networks using the historic data and predicting based on different parameters. The prediction accuracy is enhanced by the choice of variables and the information used for training. Using more hidden layers and more training variables improves the prediction accuracy. For daily NASDAQ stock exchange rate prediction, it was found that a network with three hidden layers and 20-40-20 neurons in hidden layers was the optimized network with an accuracy of 94.08% for validation dataset. The feed-forward networks are the most widely used architecture because they offer good generalization abilities and are easy to implement.

Loan Application Evaluation

Banks provide loan to the users based on different factors. Neural Networks are employed to underwrite a loan and decide whether to approve or reject the loan application. Banks want to minimize the failure rate of loan applications and maximize the returns on the loans issued. The failure rate of loans approved using neural networks has been observed to be lower than that of some of their best traditional methods. Some credit card companies are now beginning to use neural networks in deciding whether to grant an application. The process works by analysing past failures and making current decisions based upon past experience.

To give an idea about how this works, let us consider the following example factors that we assume are used in selecting loan applications:

Input Factors:

MaritalStatus, Gender, YearlyIncome , TotalChildren, NumberChildrenAtHome, EnglishEducation, HouseOwnerFlag, NumberCarsOwned, CommuteDistance, Region, Age

Target Variable: LoanApproved ( Yes or No)

The training data with the input factors are fed into the neural network so that they get trained. Once they are trained, LoanApproved is found out for any different set of input factors not present in the training set. This is called test set or real time data. Based on how the neural network learnt the input data, the accuracy of the prediction of Target Variable is done.

The prediction accuracy depends on the differing input factors as well as number of hidden layers in the neural networks. Adding a few more hidden layers till the optimum level usually improves the accuracy.

Credit Card Customer Search:

Credit card businesses require obtaining ideal customers so as to remain profitable. If the customers don’t spend much using credit card or use revolving credit line, then the business will not be profitable. Therefore per card revenue will be much lower than per card cost resulting in a low breakeven percentage. This is a very crucial issue for banks because the incremental and incidental costs exceed the revenue resulting in a non-profitable business. A study conducted on this approach involved key eigenvalues that were obtained which more accurately predict ideal customers. Eventually, after many rounds of testing, 14 eigenvalues with the lowest error rates were settled when acquiring credit card customers. This eliminates instances in which credit cards are issued to customers with no credit card needs, and allows more meaningful questions to be provided on credit card applications to better identify ideal customers.

In addition to the above applications, neural network can be applied to the following areas in the financial world:

-

- Currency prediction

- Futures prediction

- Bond ratings

- Business failure prediction

- Debt risk assessment

- Credit approval

- Bank theft

- Bank failure

From this article, we find that neural networks are useful when applied to financial applications. Even an accuracy of 85-90% would be an improvement over the methods humans use since it may not be feasible to reach 100% accuracy.

- Boomi NetSuite Integration – Best practices to follow during your Netsuite project - May 2, 2019

- Role of Master Data Management in integrating data from disparate systems - September 25, 2018

- Financial Applications of Neural Networks - February 22, 2018

Comments