According to the Q1 2017 Forrester Wave report on robotic process automation (RPA), enterprises are under immense pressure to digitize operations, and most see RPA as a part of their automation strategy.

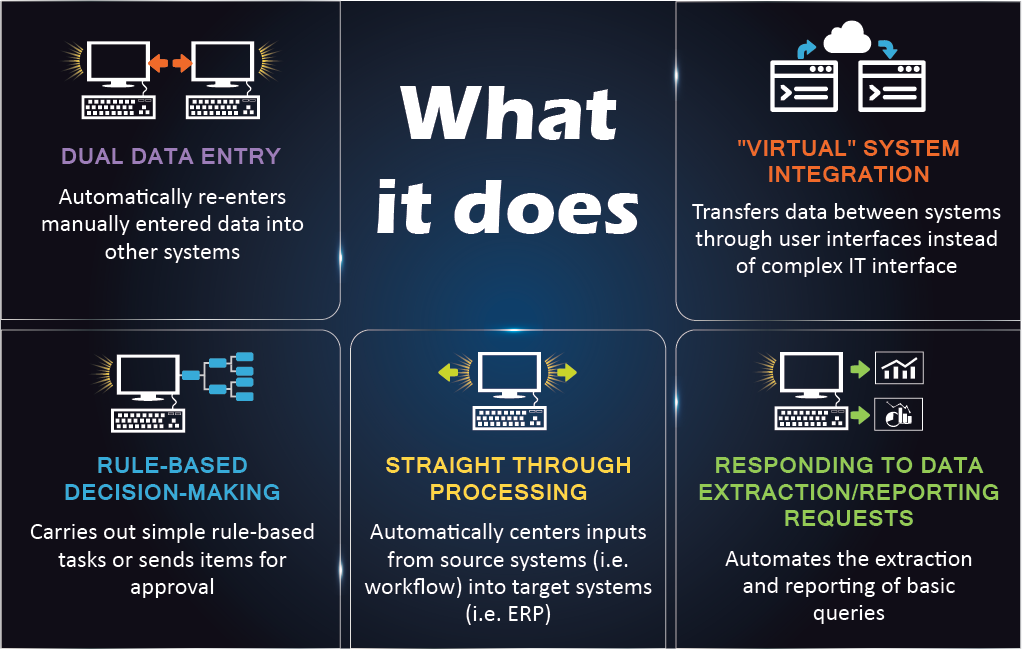

Robotics Process Automation is a digital innovation that has been increasingly replacing humans in many sectors. RPA performs human intensive, laborious everyday repetitive tasks within a minimum timeframe.

Forrester notes that RPA is poised to become a $2.9B market by 2021, and a large part of its appeal is how quick and easy it is to deploy.

RPA in FPA:

We have already seen in our earlier blog how RPA is replacing humans with the digital workforce. In this blog, let’s focus on Financial Processes that can be optimized with the help of RPA.

During month-end closure, a spreadsheet is permanently open in every computer of the Finance team. That’s when an accounts executive wishes these processes were automated.

Using multiple spreadsheets for various tasks across multiple users not only uses up valuable time but also introduces many errors like data transposition, overwriting and misplacement of information. Your team might be diligent and committed but human error is inevitable.

Many industries are now leveraging the RPA technology to fully automate the finance and accounts processes. As a revolutionary technology that replaces human workforce to perform mundane, repetitive tasks, RPA has a lot to offer to financial processes that usually involve handling large figures.

Automatic Journal Entry Generation:

Journal entries are labor intensive work that takes up too much of our valuable time. With manual interaction, it not only becomes inefficient but also risky. There are no validation checks at any point in spreadsheets and with just a pair of human eyes, the possibility of error occurrence is very high. This leads to unnecessary risk like incorrectly booked entries, rushed approvals due to time-consuming journals, late sign-offs and missing information for auditors due to lack of controls in shared drives and filing cabinets.

With the help of RPA, these potential risks can be avoided and the accurate end results can be obtained.

According to the Institute for Robotic Process Automation, robotic automation can cost as little as 1/3rd of the price of an offshore full-time employee (FTE) and as little as 1/5th of the price of an onshore FTE.

Account Reconciliation:

Accounts reconciliation is checking the account balances across accounts at the end of a particular accounting period.

Accountants generally have to perform account reconciliation which is a labor intensive process. It involves the following steps:

- Compare account balances between various independent systems

- Verify statements and reports for accuracy and investigate discrepancies when identified

- Take action to correct these identified discrepancies

Such a laborious work can, however, be simplified with the help of RPA. The digital workforce will improve your month-end closing process. Studies show that a human worker can reconcile around 8 transactions per minute. With the help of RPA – this number can be multiplied by 10,000.

Automated Management Reports:

Finance report preparation is a tedious process which involves Swivel Chair Automation. The labor intense work of keying in everyday revenue into an excel sheet, creating a report and sending it out doesn’t sound very exciting. With RPA, information gathering from the various spreadsheets can be easily automated and fed into a single document for report generation and sent to the list of e-mails. With RPA, much of valuable time and effort are saved.

Invoice Processing:

A research by Aberdeen group states that it takes between 4.1 to 16.3 days for companies to process an invoice from receipt through payment approval.

Finance and accounting pose a significant challenge in most of the business. A/P processes are tedious, time-consuming and require a high level of human involvement.

A study by Canon Business Process Services suggests that more than half of all invoice processing requires at least 76-100% manual input. This intense work of invoice processing in AP & AR can be easily automated by implementing RPA technology.

Different suppliers send invoices in different formats. It’s challenging for employees to convert the file type each time. They have to manually fetch details from one sheet and feed it into another. The entire process is thus time-consuming and error-prone. Robots, on the other hand, effortlessly perform these tasks within no time. They convert all the incoming files to pdf format and store in a common folder. The information in the invoices is unstructured and can be a tedious process for human eyes to read to capture. With the Optical Character Recognition (OCR) feature in RPA, the Robots easily capture even unstructured data, structure and analyze the data, and feed the necessary information in the relevant files. With these advanced developments, invoice processing has become easier and accurate in the recent years without much of human involvement.

Based on a recent report by Transparency Market Research, RPA is expected to see a compounded annual growth rate of about 60.5 percent worldwide through 2020. It is evident from the statistic that RPA will be able to deliver transformation in a short period of time. The expectation for a finance function is that, a highly scalable technology that can deliver at an extraordinary speed, accuracy, and cost efficiency. No other technology can meet these expectations, but RPA.

- Empower Commerce with Oracle Retail Omnichannel Suite - February 20, 2019

- Top 9 necessary optimizations for your Ecommerce UX Audit – Part 3 - November 28, 2018

- Top 9 necessary optimizations for your Ecommerce UX Audit – Part 2 - October 29, 2018

Comments